What Does It Mean to Be an Independent Contractor?

Independent contractors act as their own business entities, offering clients or companies contractual services. This arrangement provides a unique blend of flexibility and autonomy, marking a significant shift from the conventional employer-employee relationship. Let's look at the critical distinctions between independent contractors and traditional employees.

1. Autonomy in Work

Independent contractors have the freedom to dictate how, when, and where they complete their work, unlike employees who typically follow the schedules and protocols set by their employers.

2. Contractual Relationships

While employees are bound by employment contracts that typically offer long-term job security and defined roles, independent contractors engage in project-specific contractual agreements with clearly outlined deliverables and timelines.

3. Tax and Financial Responsibilities

Independent contractors handle tax obligations, such as self-employment taxes and quarterly tax payments. It differs from employees, whose employers usually withhold and manage taxes.

4. Benefits and Protections

Traditional employees often receive health insurance, retirement plans, and workers' compensation. In contrast, independent contractors are responsible for securing their benefits and do not receive the protections afforded to employees under labor laws.

5. Equipment and Resources

Employees generally work with tools and resources provided by their employer, whereas independent contractors are expected to supply their own equipment necessary for completing their work.

Importance of Pay Stubs for Independent Contractors

In contrast to traditional workers, independent contractors may not receive regular pay stubs from their clients. However, generating your pay stubs is an invaluable practice for several reasons:

- Pay stubs serve as official documentation of earnings, which is crucial for independent contractors who need to validate their income. It is crucial when applying for loans, renting property, or making significant purchases where proof of financial stability is required.

- For independent contractors, maintaining accurate financial records is essential for tax purposes. Pay stubs simplify the process of tracking income, making it easier to report earnings accurately and efficiently during tax season. They help calculate self-employment taxes and can be used to justify deductions and expenses.

- Creating pay stubs reflects a level of professionalism. It demonstrates an organized approach to managing finances, which can enhance credibility with clients and financial institutions.

- Regularly generating pay stubs enables independent contractors to monitor their earnings over time. It is vital for effective budgeting, financial planning, and understanding income trends, which can inform future business decisions and strategies.

- In a disagreement with a client over payment terms or amounts, a pay stub can serve as a reliable reference, providing detailed information about the payment made for services rendered.

- Sometimes, local or state laws might require income documentation for independent contractors. Pay stubs fulfill this requirement, ensuring compliance with legal standards.

In essence, pay stubs are not just financial records for independent contractors; they are tools that aid in maintaining financial health, ensuring legal compliance, and fostering professional growth.

Essential Elements of an Independent Contractor Pay Stub

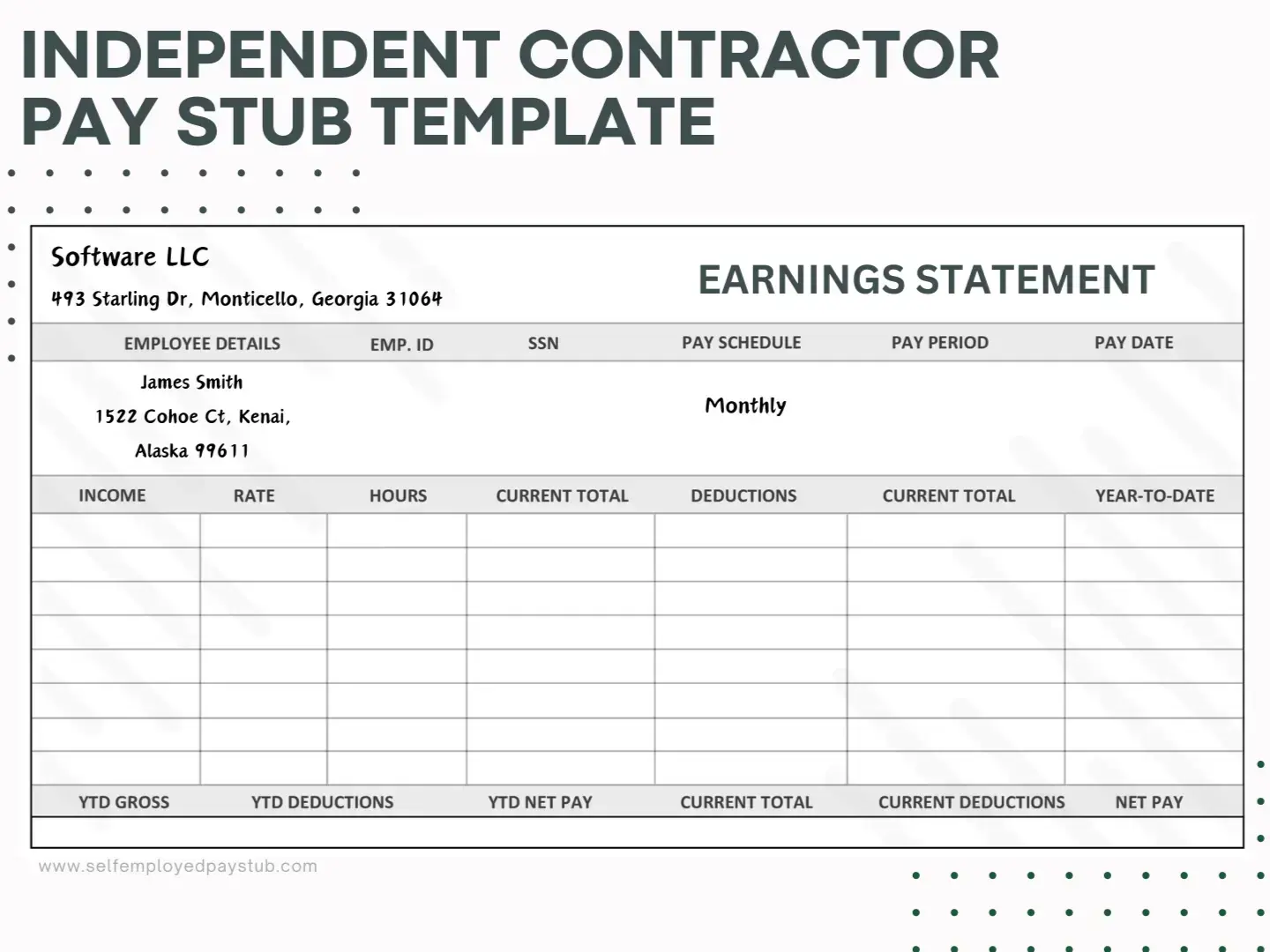

Creating an effective pay stub for an independent contractor involves integrating several key components. Each element ensures the effectiveness of this document for financial management, tax reporting, and income verification.

1. Personal Information

Including the contractor's full name and address is fundamental for identification and record-keeping. An Identification Number, such as a Social Security Number (SSN) or an Employer Identification Number (EIN), is essential for tax-related identification.

2. Payment Details

This section covers the gross pay, the total amount earned before deductions, the net pay, and the take-home amount after deductions. It also details the pay date or period, clarifying the timeframe for the earnings, which is crucial for record accuracy.

3. Tax Information

A pay stub must detail federal and state taxes, showing withheld or calculated amounts for tax compliance. It should also include self-employment taxes, reflecting contributions towards Social Security and Medicare, as independent contractors are responsible for these payments.

4. Deductions and Contributions

It is essential to document any business-related expenses deducted from the gross pay and contributions to retirement plans, if applicable. These details assist in financial planning and tax deductions.

5. Additional Details

Incorporating a reference, such as an Invoice Number or Project ID, links the pay stub to the specific work performed. Including client information, like the name and details of the client, adds an extra layer of documentation for the income source.

What Is an Independent Contractor Pay Stub Template?

A pay stub template is a customizable document used by individuals who work freelance or on contract rather than as traditional employees. This template allows them to generate pay stubs for their income from various projects or clients. While employees receive pay stubs from their employers, independent contractors often need to create their own, and the right pay stub template simplifies the process.

Pay stub generator saves time and reduces the likelihood of errors compared to manually creating such forms. This efficiency is beneficial for small businesses or freelancers without dedicated payroll software. Moreover, a pay stub template ensures uniformity in the pay stubs produced, which is crucial for consistent record-keeping and easy review over time. These forms are designed to be user-friendly, requiring minimal training, making them accessible to a wide range of users, including those without a background in accounting or payroll.

From a cost perspective, a basic pay stub template is a budget-friendly solution. Many of these forms are available at a minimal cost or even for free, making them a cost-effective choice for businesses looking to reduce overhead expenses. Another significant aspect of using a simple pay stub template is its alignment with legal requirements. A well-designed form is updated to comply with the latest local, state, and federal regulations regarding payroll information, which is crucial for avoiding legal complications.

Customization is another benefit. Users can tailor a blank pay stub template to fit the specific needs of their business, adding or removing elements like deductions, overtime, and bonuses as necessary. This flexibility is invaluable for businesses with unique payroll requirements.

In addition, a comprehensive paycheck stub template also adds a professional look to the documents you create. This professionalism is important for maintaining employee trust and is crucial when employees need organized pay stubs for financial transactions such as loan applications or property rentals.

Creating Pay Stubs for Independent Contractors: Best Practices

Clarity and professionalism are paramount when designing a pay stub for an independent contractor. The pay stub should be a payment record and an income document reflecting the contractor's business acumen and attention to detail. Here are some best practices to consider:

Ensuring Clarity and Accuracy

When you create pay stubs, the primary goal is to communicate the details of the contractor's earnings and deductions. Ensure that all information is accurate and easy to understand. It includes using straightforward language and clear categorizations for different earnings and deductions. The perfect pay stub template should be intuitive, with a logical flow that can be quickly followed by anyone reviewing the document.

Maintaining Professionalism

The design of the pay stub should be professional. It means avoiding overly elaborate fonts or unnecessary graphics that can detract from the document's purpose. Stick to a clean, simple layout of the check stub template that conveys a sense of professionalism. When you generate pay stubs, incorporating elements such as the contractor, company logo, or brand colors can add a personalized touch while maintaining a professional appearance.

Using Pay Stub Templates vs. Custom Designs

For many independent contractors, a template is a convenient and efficient way to create pay stubs. Templates provide a pre-structured format covering all the essential elements, ensuring nothing important is missed. They are handy for those who may not have extensive accounting or design experience.

However, custom designs can be a better option for those seeking more control over the content of their pay stubs. Custom-designed pay stubs allow for greater flexibility in how information is presented and can be tailored better to reflect the contractor's brand and business style. This approach may require more time and possibly some design skills, but it offers the advantage of creating a unique document that stands out.

Regardless of whether a template or a custom design is used, the key is to create pay stubs that are both functional and professional. It should accurately reflect earnings and deductions while also serving as a testament to the contractor's commitment to professional business practices.

How to Fill Out the Pay Stub Template for Contractors

Filling out a pay stub template is straightforward but requires attention to detail to ensure accuracy and completeness. Here's a step-by-step guide for contractors who want to create professional pay stubs with the template.

1. Enter Personal Information

Begin by entering your personal information. It includes your full name, address, Social Security Number (SSN) or Employer Identification Number (EIN). This information is crucial for identification and tax purposes.

2. Detail the Pay Period

Specify the pay period the pay stub is covering. It should include the start and end pay date of the period you are being paid. It's important for record-keeping and helps understand the income flow over specific time frames.

3. Input Earnings

Enter the amount you have earned during the specified pay period. This is your gross pay, the total amount before any deductions are made. If your pay varies based on the project or hours worked, ensure you calculate the total earnings accurately for the period.

4. Deduct Taxes and Other Contributions

It may include federal and state taxes and contributions to Social Security and Medicare (self-employment taxes). If you have made pre-tax contributions, such as to a retirement plan, these should also be deducted here.

5. List Any Additional Deductions

If you have business expenses or other deductions specific to your work as an independent contractor, list them in this section. It could include costs for equipment, travel, or other business-related expenses.

6. Calculate Net Pay

Subtract all the deductions from your gross pay to determine your net pay. This is the amount you take home. It's vital to double-check these calculations to ensure accuracy when you use a pay stub generator.

7. Review and Finalize

Review all the details in the pay stub for errors once all the information is entered. Ensure all the figures are correct and the information is presented clearly. It is your final chance to correct mistakes before finalizing the pay stub.

8. Save or Print

After reviewing, save a digital copy of the pay stub for your records. You may also want to print a hard copy, depending on your preference, or for record-keeping purposes.

To Sum It Up

More than just a financial document, a well-designed pay stub is a cornerstone of financial empowerment for independent contractors. Meticulously documenting earnings and deductions lays the foundation for sound financial management. We encourage independent contractors to adopt best practices for creating and maintaining these stubs, as they play a critical role in ensuring financial clarity, tax compliance, and overall business success.

Related Posts

Follow these links for valuable insight and guidance on how to manage payroll for independent contractors efficiently:

- Pay Stubs and Contractors: A Must-Have Tool for Financial Success

- Independent Contractor Financial Management: How to Design Pay Stubs

- What to Include in Your Independent Contractor Pay Stubs

- How to Handle Employee Details on Independent Contractor Pay Stubs

- Privacy Concerns Surrounding Independent Contractor Pay Stubs

- Top Pitfalls to Dodge While Creating Independent Contractor Pay Stubs

- Legal Guidelines on Pay Stubs for Independent Contractors

- Digital Pay Stubs: Empowering Independent Contractors for Success

- Tips for Managing Emergency Contact and Medical Details on Pay Stubs

- Managing Federal Taxes on Independent Contractor Pay Stubs

- How Independent Contractors Should Handle Social Security and Medicare Taxes

- How to Properly Report Contractor Earnings to the IRS

- Pay Stubs: Essential Tax Deductions for Contractors

- Examining the Pros and Cons of Independent Contracting

- How to Access Insurance and Benefits as an Independent Contractor

- Contractor Compensation: How Contract Duration Affects the Paycheck

- Mastering the Art of Contract Renegotiation and Extension for Independent Contractors

- Full-Time Job or Independent Contractor? Clarifying the Contrasts

- Understanding the Legalities of Ending Independent Contractor Agreements

- Contractor's Financial Toolkit: the Value of Pay Stubs

- Writing Effective Job Descriptions for Independent Contractors

- Payment Terms: Top Strategies for Contractors

- Best Practices for Dispute Resolution in Contractor Agreements

- Legal Insights on Work Hours for Independent Contractors

- How Confidentiality Clauses Enhance Pay Stubs for Contractors

- Creating Contractor Pay Stubs with Online Tools

- Time Management Tips for Successful Independent Contracting

- Creating a Safe Workspace: Independent Contractor Safety Procedures

- Contractor's Guide to Renewal and Termination

- Why You Should Care About Verifying Your Pay Stubs

- The Importance of EIN in Your Business as Independent Contractor

- EIN or SSN? Understanding the Key Differences

- Get Your EIN: Successful Application Process

- The Complete Guide on Independent Contractor Management